Drivers of a Common Investor

What Drives A Common Investor

Fear, Greed, Hype & Lack of Trust

Singapore June 20th 2014 Friday; Swissotel The Stamford

What to Fear : Is it justified?

Absolutely Justified: Evolution made mankind to survive and thrive over more powerful or more venomous animals because we Fear. Fear a Lot!

It is better to be wrong 99.99% of the time imaging “Rope as a Snake” than being brave 0.01% time and get bitten by a “Snake which looked like a Rope”!!

Lose Bravery Award than Losing Life (or Livelihood)!

Absolutely Justified: Handling risk or uncertainty is not a tool God has given us.

We are engineered to LOVE and LIKE predictability, certainty and assurance of favorable outcome and HATE and DISLIKE unpredictability, uncertainty and chance factor.

It is how we are designed for OUR OWN SURVIVAL (BTW, Otherwise Survival of God Will Be at Stake!!! Think….)

“GOOD LUCK” ==== Good God!! God is Great!!!

“BAD LUCK” ==== God is Cruel / Destiny ………

What to Fear Out There: External

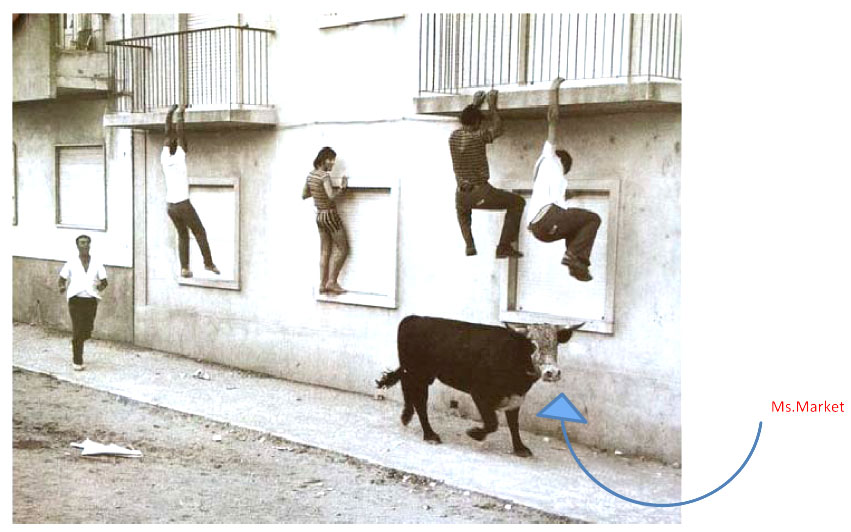

Too Many Things: Ultimate reason to fear stock market investment for common man in India: Ms. Market The Great

- Extreme Volatility (She enjoys her wild mood swings!)

- Lack of Transparency of all players: Promoters, Brokers, Large Investors, Media Houses (Her suitors and her pimps do a great job to protect her charm…!!!)

- Poor regulations and corrupt regulators (She blinds good judgment by seducing the Rulers and the Riches!)

- Overload of poor quality information: Noise & Cacophony (She is too enigmatic! Seldom speaks her mind!)

- Absence of good quality information: Knowledge & Insight (Isn’t it obvious from above….)

- Our poor financial literacy and inability to differentiate “Information” from “Noise” (We the poor mortals are mere toys in the playroom of this timeless beauty….!!! We love to lose our good sense, at least when we are in the middle of the play! Aren’t we??)

ALL POINTS ABOVE HAVE BEEN INTENTIONALLY MADE POINT NUMBER ONE

What to Fear In Here: Our Own Self

We have too many very useful inherent traits which helped us to become the ruler of the Animal Kingdom and civilizing this tiny planet called Earth from Evolutionary point of view……

- Our own greed, passion & desire to have more ….

- Our lack of knowledge and understanding of market dynamics

- Our herd mentality …

- Our impatience …

- Our impulse of avoid pain at any cost …

- Our fear of the unknown ….

Think and in no time you will realize how important and critical these traits were from evolutionary purposes for taking us where we have reached today as “Homo Sapiens”…..

If both external and internal reasons are so compelling not to venture in stock market then what’s the point …….???

Well then what’s the point in being a Human Being and not just a “Homo Sapiens”??? just eat (raw!) / sleep (in field!!) / procreate (wherever!!!)

Just Kidding!!!!……

Homo Sapiens have made Human Civilization and a Functioning Society in spite of all these odds….!

Reasons for Hope

Our human society and human civilization is built by a trade off between our impulses and raw instincts vis‐à‐vis our collective reasoning and “trained” intuitions honed by experience and practice over long period of time…..

In money matters we generally fall prey to our raw instinct to be safe and secure and fear anything and everything unknown.

We can’t distinguish between “RISK” & “UNCERTAINTY” (it is very critical for investment management)

Risk vs. Uncertainty

Risk: I know that “I don’t know” …..

Example….

- I know when a dice is rolled, the outcome would be between 1 – 6 (can’t be anything else)

- I know when a polling is held one of the candidates would win (none who didn’t contest the poll would win)

- I know that a baby would grow in weight but can’t predict the future figure (meanwhile due to temporary illness she may lose some weight)

Be very afraid of taking risk to protect capital

Uncertainty: I don’t know that “I don’t know” ….

Example….

- A meteor can hit the earth tomorrow but chances are very low

- Will the sun is really going to rise again tomorrow but chances are very high

- Will the stock index is going to go up or down tomorrow but over a longer period it would only go up

Be willing to embrace some uncertainty (not risk) to reap the benefit of higher returns

To differentiate between the two makes one a capable investor / fund manager / portfolio adviser ….. “Head” & I win handsomely, “Tail” & I don’t lose that much…”

My two cents why you should invest in India (mostly cliches)

- Participate in India growth story profitably

- Enough very good quality companies and promoters

- Enough instances of people making good wealth from stock market

- Beat Indian inflation significantly

- 8% – 10% range SGD / USD based return (min. investment SGD 150,000)

- Take non‐taxable or minimally taxable gains

- Take (limited) benefit from volatility

- Over long term no other asset class gives better return than equity

AND OBVIOUSLY IT IS GOOD TO EARN GREAT RETURN ON INVESTMENT BUT WISELY …. PRUDENTLY ….. SMARTLY

My two cents why you should invest & Invest in Indian equities

(NOT cliches but FACTS)

India is transitioning from a high interest, high inflation environment

Low commodity and Low crude price would benefit India most

Economy moving from consumption led to investment led growth to build up next stage of consumers

To make transition, corruption, black‐money and crony capitalism is being gradually contained

Globalized economy made the policy choices limited for governments so irrespective of which government is in power, the pace of reforms may be bumpy but unidirectional

India has enough good companies with ethical promoters (at least 10% of all listed companies)

It is still a very small economy in a global scale and has huge runway to cover

Over long term no other asset class gives better return than equity for next 5 – 10 years

Now The Most Important and The Most Critical Question

“What about the risk of losing or eroding my capital?”

“Forget return, I want my Principal Protected”

(Return of Capital vs. Return on Capital!)

10% ‐ 20% down side in a 3 year frame…. Chance <<20> (if anyone says your capital is safe and secured 100%, then please be very scared!)

10% ‐ 15% down side in a 5 year frame…. Chance <<5>

15% ++ annualized INR return over 3 – 5 years and beyond… Chance >>75%

Yes, this trade off between uncertainty (not risk) and return you need to keep in mind for beating inflation and for substantially higher returns (if not interested please don’t venture into it)

Avoid if you want but don’t Chase Market from Behind

(For those who want to do it on his own)

- Invest with adequate “Margin of Safety”… Never ever invest without due research.

- Invest only after thorough understanding of company financials, business model, economy, competition, market opportunity, future prospect, promoter group credentials and its ability to create a sustainable value…

- Invest not with “Hope” but with “Conviction” but have the “Mental Flexibility” to quickly change mind with new information which may reduce conviction.

- Seek expert advice if you think you can’t handle it. But don’t miss out on the opportunities.

Relation between Ms. Market and

Common Investors…….

Confidential. Meant for audience only. Not

to be recirculated. Owned by Aveek Mitra